how to calculate nj taxable wages

All of the rates above apply to New Jersey taxable income which is total income including capital gains minus certain deductions as well as the New Jersey personal exemption of 1000. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Peoplesoft Payroll For North America 9 1 Peoplebook

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

. If you are not using the tax bracket you must. Line 1 - Wages and Other Amounts Subject to Gross Income Tax Enter the total wages and other amounts paid during this quarter that are subject to GIT Withholdings. New Jersey Income Tax Calculator 2021.

1216-48 the following are the calculated dollar equivalents for board and room meals and lodging furnished by employers in lieu of money wages paid for services rendered by employees during. After a few seconds you will be provided with a full breakdown of the tax you are paying. Unlike the Federal Income Tax New Jerseys state income tax does not provide couples filing jointly with expanded income tax brackets.

NJ Taxation As a seller you have the option of calculating Sales Tax due using either the tax bracket See Sales Tax Collection Schedule Form ST-75 or by multiplying the taxable receipts by the applicable tax rate. Calculate salaried employees paychecks by dividing their salary by the number of pay periods per year. If you make 70000 a year living in the region of New Jersey USA you will be taxed 10707.

The New Jersey tax calculator is updated for the 202122 tax year. The New Jersey income tax calculator is designed to provide a salary example with salary deductions made in New. You must report all payments whether in cash benefits or property.

If you make 0 a year living in New Jersey USA we estimate that youll be. Apply the taxable income computed in step 3 to the following table to determine the annual New Jersey tax withholding. Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to expect when planning your budget.

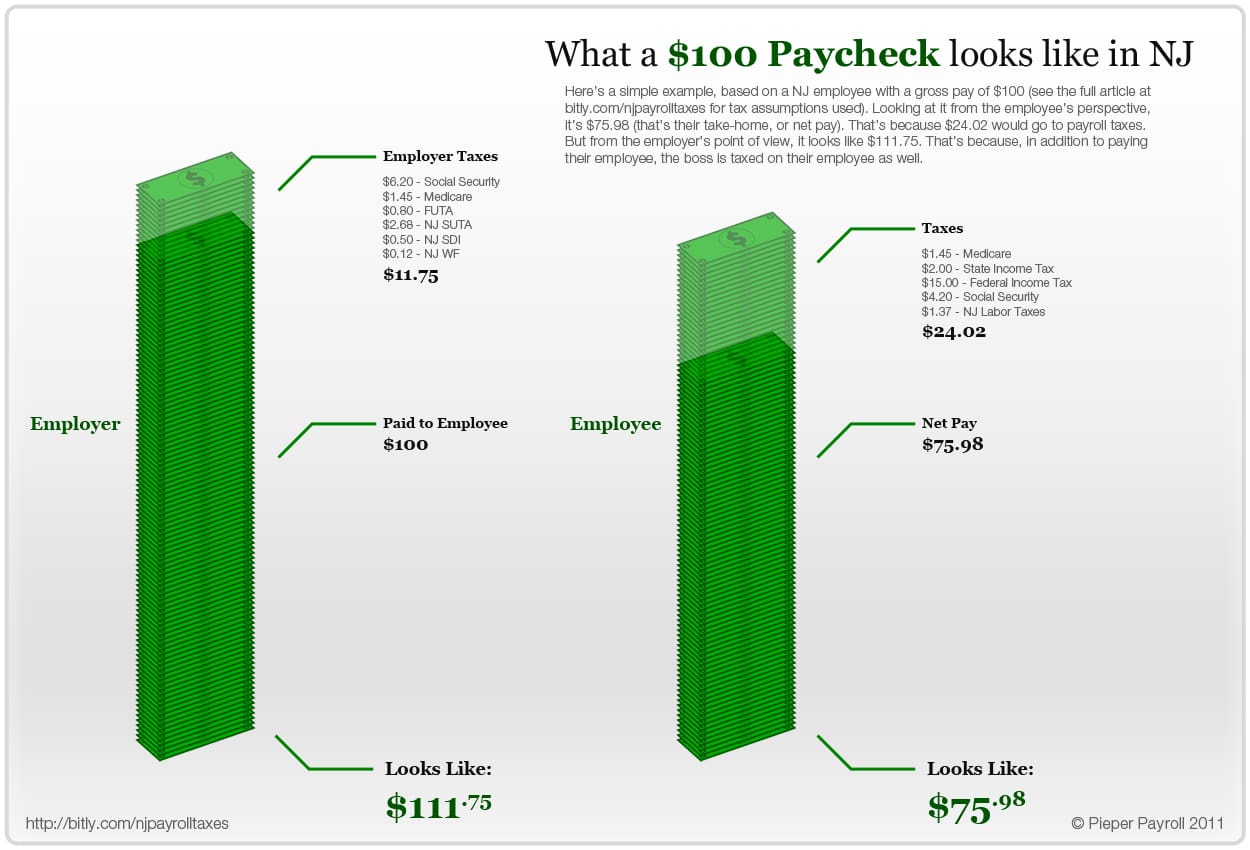

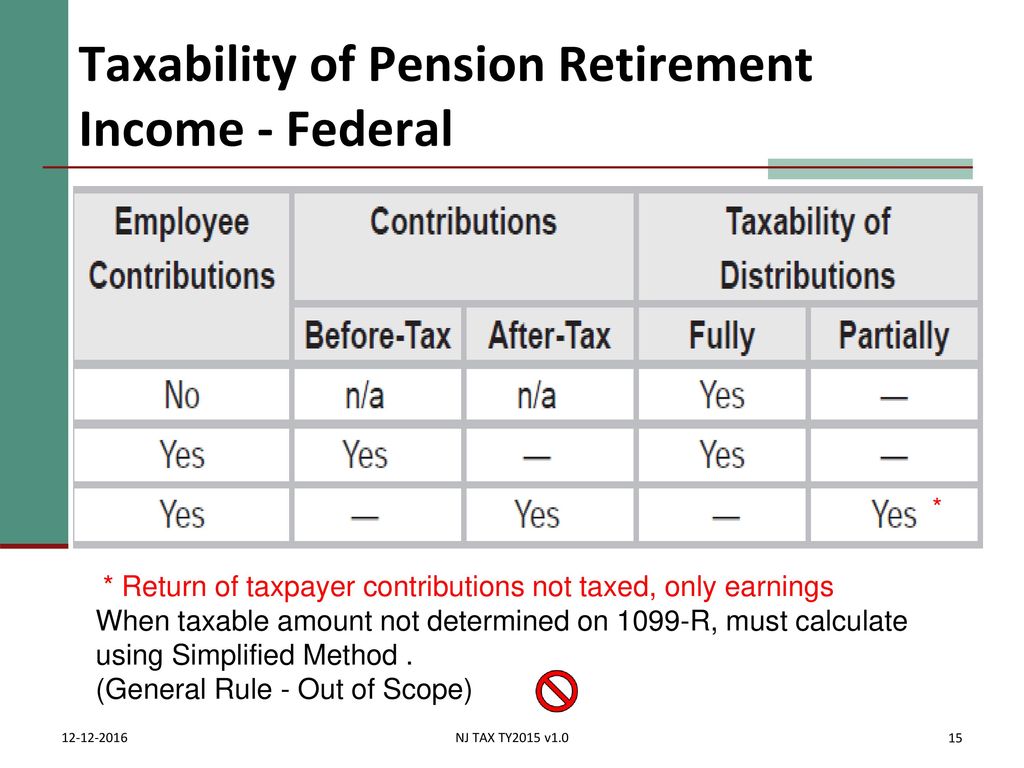

Here is the formula for calculating taxable wages. The NJ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NJS. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans.

New Jersey collects a state income tax at a maximum marginal tax rate of spread across tax brackets. There are two main types of wages. New Jersey Paycheck Quick Facts.

Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. Far too many people fail to allow for the full income tax deduction allowances when completing their annual tax return inNew Jersey the net effect for those individuals is a higher state income tax bill in New Jersey and a higher Federal tax bill. If you are a New Jersey resident wages you receive from all employers are subject to New Jersey Income Tax.

2020 Taxable Wage Base UI and WFSWF - workers and employers TDI employers. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked.

New Jersey Income Tax Withholding. Exemption Allowance 1000 x Number of Exemptions. Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee.

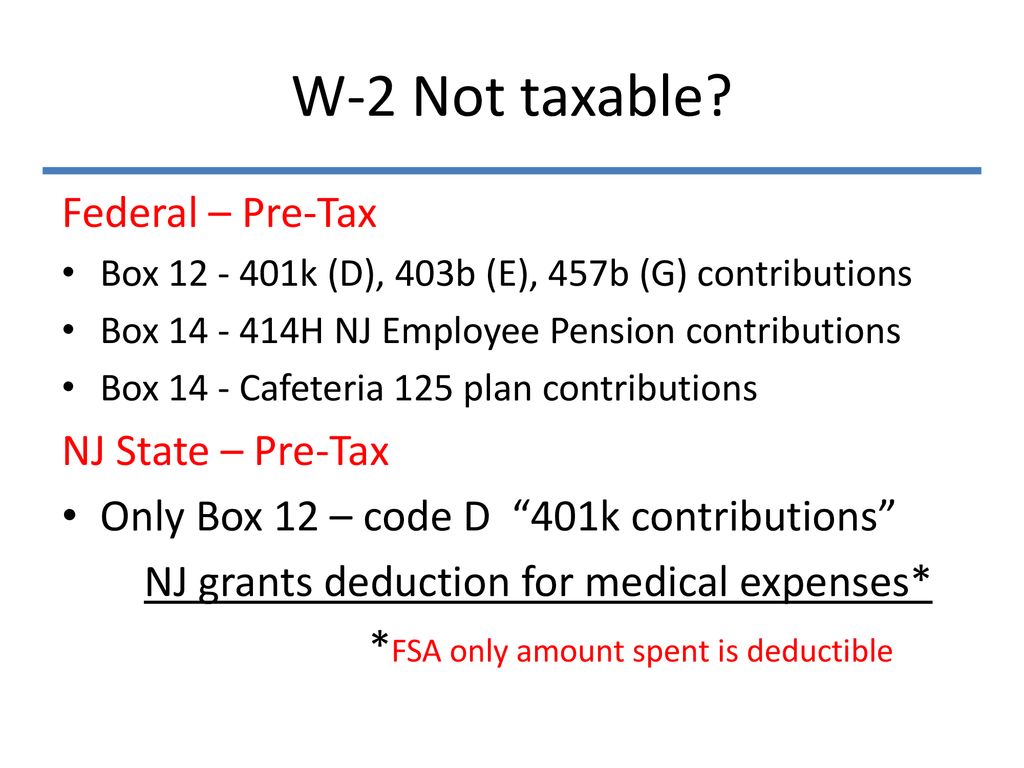

Enter your salary into the calculator above to find out how taxes in New Jersey USA affect your income. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable.

Exemption Allowance 1000 x Number of Exemptions. Calculate the tax to the third decimal point. Taxable Income in New Jersey is calculated by subtracting your tax deductions from your gross income.

If the amount is zero enter 0 For more information on wages and other compensation subject to withholding see the New Jersey Gross Income Tax Instruction Booklet Form NJ-WT. The filing status affects the Federal and State tax tables. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Census Bureau Number of cities with local income taxes. New Jerseys maximum marginal income tax rate is the 1st highest in the United States ranking directly below New Jerseys. NJ Income Tax Wages.

35300 2020 Taxable Wage Base TDI FLI workers only. Using our New Jersey Salary Tax Calculator. New Jersey income tax rate.

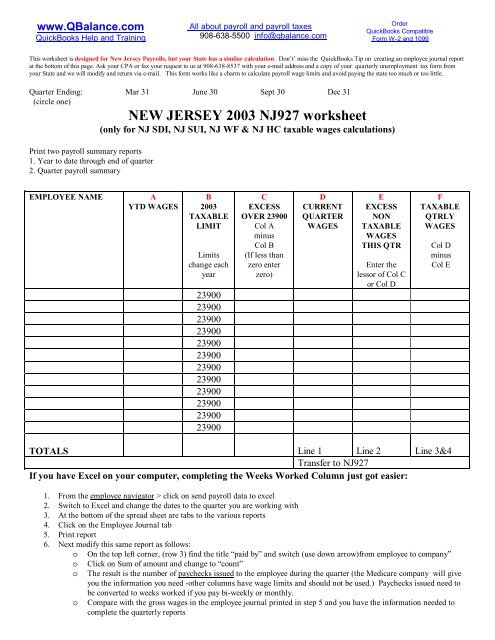

How to Calculate Salary After Tax in New Jersey in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages. Apply the taxable income computed in step 3 to the following table to determine the annual New Jersey tax withholding.

134900 In accordance with NJAC. How do I calculate NJ Sales Tax. Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Instructions for the Employers Reports.

Taxable Retirement Income. Some forms of income that are not taxable include unemployment compensation Social Security benefits workers compensation and lottery winnings of 10000 or less.

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

New Jersey Slides Tax Year Ppt Download

Form Nj W4 Employee S Withholding Allowance Certificate

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

How To Calculate Taxable Income H R Block

New Jersey Slides Tax Year Ppt Download

New Jersey Nj Tax Rate H R Block

Pub 17 Chapter 10 11 Pub 4012 Tab D 1040 Line 16 Ppt Download

Pub 17 Chapter 10 11 Pub 4012 Tab D 1040 Line 16 Ppt Download

Form Nj W4 Employee S Withholding Allowance Certificate

Solved I Live In Nj But Work In Ny How Do I Enter State

2020 New Jersey Payroll Tax Rates Abacus Payroll